Software vendors provide new procure to pay (PtP) functionalities which promise to decrease significantly your vendor invoice processing cost, increase the PtP process visibility, and activate financial income from your working capital. These functionalities include:

- automated invoice matching processing (aka touch-less processing): OCR your invoice images or receive electronic invoice and match against supporting documentation without AP clerk or business activity,

- vendor portals: vendor submits electronic invoices, monitors your payments and updates his vendor master data;

- dynamic discounts: use your balance sheet to propose early payment discounts to your vendors;

- robotics: support your call centre with decision making tools to guide through payment queries, provide automated voice answering, or automate the non-matching invoice resolution workflow; and

- automate payments: increase the usage of electronic payments.

These tools can improve, sometimes dramatically, the productivity of your invoice processing teams, reduce the number of vendor queries, increase the visibility of the invoice processing, and improve your control effectiveness. In addition it will allow you to use your balance sheet to generate financial income. Finally, these tools will help focus your teams on value-added activities.

Realizing these benefits will depend on many factors, including the quality of your project teams. But also, there may be structural hurdles you may have to take into consideration:

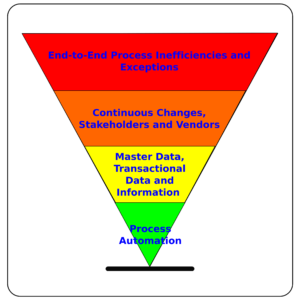

Hurdle 1: The quality of your current end-to-end PtP processes.

You can easily assess your end-to-end process quality by e.g. looking at the percentage of invoices matched without AP clerk intervention, the visibility of the process, or the occurrence of vendors with major payment complaints. The root cause of these inefficiencies may occur in the upstream processes, in the vendor master data maintenance process, in the system configuration, in miscommunication between the vendor and your company or miscommunication between finance and upstream PTP process stakeholder. These root causes will most probably not get resolved by automating a section of your PTP process and have the potential to negatively impact and even disrupt your automation projects.

Hurdle 2: Your capacity to improve your processes robustly

To resolve the process quality issues, you can include a process clean-up as  part of your automation project scope. This will enable a successful go-live of your project and attain your objectives for a while. The challenge is to understand that it is the process that you need to continuously manage. As soon as you close your automation project, you will face changing demands from vendors and process stakeholders. In addition your company will engage in projects affecting your automated processes. You need to manage the PtP process, the PtP process stakeholders and the vendor master data maintenance process to ensure that you can keep up and improve the process efficiency and effectiveness.

part of your automation project scope. This will enable a successful go-live of your project and attain your objectives for a while. The challenge is to understand that it is the process that you need to continuously manage. As soon as you close your automation project, you will face changing demands from vendors and process stakeholders. In addition your company will engage in projects affecting your automated processes. You need to manage the PtP process, the PtP process stakeholders and the vendor master data maintenance process to ensure that you can keep up and improve the process efficiency and effectiveness.

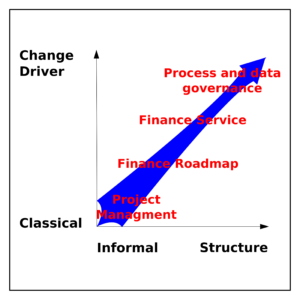

Hurdle 3: Do you have the right resources post automation projects?

In an organization that support low automation or less efficient PtP processes, resources are mostly dedicated at analyzing non-automated transactions invoice by invoice, initiate the correct business review process and perform pre-posting manual controls. The objective of the automation project is to cut these activities. An outcome of the automation project is that you will need to manage the PtP process. The project will thus result in a reduction of your resources, and change the skills requirements of your staff. Confederation of your stakeholders, process analysis, communication, project management, change management are amongst others the skills that your staff will need to possess.

Hurdle 4: Do you have realistic goals and a realistic timeline?

Automation projects encompass changes within your finance organization, changes in the skills your staff needs to possess, and process changes at your stakeholders and your vendors. These changes need attention, time and resources and may prove to be much more complex than the system configuration or the vendor on-boarding process. You need to understand these changes and include the necessary scope, time and resources in your projects to be successful.

To successfully implement PtP automation projects, you do not only need to plan for the system enablement. You need also to incorporate changes in organization and implement new practices to manage your end-to-end processes. In addition, skills requirements in your organization will change, and you will have to set up new collaboration models with your stakeholders and vendors.