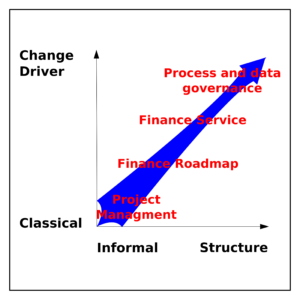

It is good practice to regularly assess the performance of your finance organization and define if and how much you want to reduce costs and improve effectiveness. As part of the exercise, you want to investigate the biggest challenges faced by companies who performed similar changes. The most common feedback relates to project management execution: lack of sponsorship, poor execution, unrealistic business case, poor project management, scope changes...

Moreover some finance organizations are more effective at attaining change objectives. Here are some distinctive characteristics of some of these organizations:

- Process improvement is a permanent activity that includes projects.

- Finance processes are managed end to end.

- Stakeholders pro-actively support project change activities and manage project process quality deliverables.

- Quality practices are in place to ensure process effectiveness and data quality.

- Processes are actively managed to seize opportunities, resolve issues and

Higher change capability may lead to more effective use of IT systems, more robust finance performance, and reduced processing costs. There are however traits to be assumed, including cross-functional collaboration, clear process ownership, quality programs, shared medium term expectations on finance processes performance and finance department’s performance, and formalisms between finance and process stakeholders.

If you want to improve the performance of your finance organization, improving your change capability is an opportunity to consider besides organization cost reduction, process improvements and improved systems projects. Your change capability improvement will increase the value of your projects as well as to reduce the risks. If your organization lacks the experience in this area, external advisors are available to help you.